taxes on fanduel|Taxes on Sports Betting: How They Work, What’s : Tagatay If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .

Calgary police say around 6:30 p.m., several people got into a verbal fight in an open area at 1A Street and 61 Avenue SW near Chinook LRT Station. Investigators believe one of the men involved left the area and then came back a short time later with a knife before stabbing two men who were involved in the initial argument.

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes on Sports Betting: How They Work, What’s

PH2 · Taxes

PH3 · Tax Considerations for Fantasy Sports Fans

PH4 · TVG

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · Sports Betting Taxes: How They Work, What's Taxable

PH7 · How to Pay Taxes on Sports Betting Winnings

PH8 · How Much Taxes Do You Pay On Sports Betting?

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & L

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH12 · Effective Strategies to Handle Tax Withholding on FanDuel

#stlpampangaresultstoday #stlpampanga11amdraw STL PAMPANGA 1st Draw Result - Small Town Lottery STL Pampanga Result Today - 11AM drawThird Draw Result - Stl.

taxes on fanduel*******We’re legally required to withhold federal taxes from sports wagering winning transactions as well as other qualifying casino game winning transactions when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional . Tingnan ang higit pa

A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling activity, the amount of the gambling winnings, and in some cases, the ratio of . Tingnan ang higit paTaxes on Sports Betting: How They Work, What’s FanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 information reporting rules. As it presently stands, FanDuel only reports activity on . Tingnan ang higit pa

FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced . Tingnan ang higit pa If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, . Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non .taxes on fanduel Taxes on Sports Betting: How They Work, What’s FanDuel Sports Betting Taxes Guide: Do I have to pay taxes on my FanDuel winnings? How Much Does FanDuel Tax? Does FanDuel take taxes out . For 2023 tax returns (taxes filed in 2024), the standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for.

FanDuel Sports Betting Taxes. How States Tax Legal Sports Betting. Frequently Asked Gambling Tax Questions. Unless you hate money, your primary goal .

Download App. With two weeks left before the deadline to file your federal income taxes for 2022, Action Network's Sam McQuillan sat down with Richard Gartland, who's spent more than 30 years in finance, . FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off .

TVG - Taxes, W2-Gs & Year End Reports. Due to updated regulations from the IRS regarding the reporting of wager winnings, there are only two specific circumstances in .

OVERVIEW. Fantasy sports leagues can yield hefty winnings if Lady Luck smiles on you. If you win big—or even not so big—you'll need to save a portion of that . Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non-cash prizes and learn about crucial IRS forms like 1099-MISC and W-2G. Delve into professional insights on the importance of meticulous financial record-keeping and .

Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through .

DraftKings, FanDuel and other betting apps are facing a bigger tax hit in Illinois following changes to tax policy this year. New Jersey, Massachusetts and other states have also tried to raise taxes on the industry or plan to. DraftKings and FanDuel count Major League Baseball and the National Football League among their biggest .

The IRS requires gambling operators to withhold 24% of winnings for any wager that exceeds $5,000 and is at least 300 times the amount of the wager. This is known as a “backup withholding” requirement. For example, if you place a $10 bet and win $5,000, FanDuel will withhold $1,200 (24% of $5,000) and send it to the IRS on your behalf.Just check the app for the tax forms and see. Sports bets credit your losses against the wins. So if you won a $7k prize, but have wagered $5k, you will only be showing $2k as taxable income. Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I..

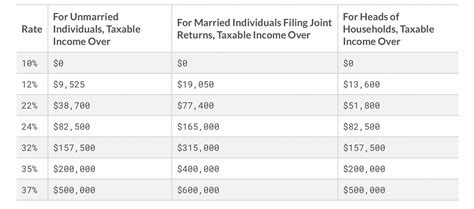

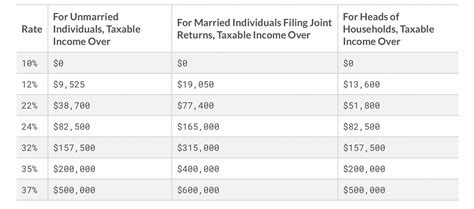

Embrace the suck. If you don't report it and the IRS has to fix your return for you, you'll absolutely be taxed on all 10,000 and your 9900 in losses won't be deducted. If you do report it (hopefully fanduel DTRT and sends you a W-2G at the end of the year, but not having the form doesn't excuse you from having to report it), you'll be able to . Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your winnings have already been withheld, make sure to report that on the 1099 or W2-G. If you never got one, contact your sportsbook or . How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel . For 2023 tax returns (taxes filed in 2024), the standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for heads .Ohio gambling taxes are on a graduated scale based on your total ordinary income. Gambling winnings from Ohio sports betting apps will count as “Other Income” but are taxed as part of your total. The parameters change over time, but as of tax year 2022 there were 6 graduated levels. Here are the rates at each level.

In 2022, legal sports wagers on sites like FanDuel and DraftKings totaled $93.2 billion. Wall Street Journal tax reporter Laura Saunders joins host J.R. Whal. To be clear, this is the tax rate that operators such as FanDuel, DraftKings and BetMGM will need to pay. An individual’s tax liabilities are a separate matter entirely, which will be discussed .Taxes Payable for FanDuel Sportsbook. In general, taxes on FanDuel Sportsbook winnings depend on the amount you have won and your overall taxable income. Any sports betting winnings over $600 (or if the amount is 300 times the original bet) are subject to a 24% withholding rate tax, which can be deducted from your winnings at the time of . Major fantasy sports sites and apps (DraftKings, FanDuel, BetMGM, etc.) have an obligation to send winners IRS Form 1099-MISC which contains all the information they need to report fantasy sports winnings for taxes. This same information is sent to the IRS, so the IRS knows if you misreport or fail to report your winnings. Taxes. FanDuel may sometimes even withhold taxes on sure bets. It depends on the winnings. If the winnings are $5000 or more where the wager was 300x, FanDuel may withhold a portion. It may withhold 24% of the winnings and remit information to the IRS. 3% of the amount may be withheld and remitted to the state. It does depend .

taxes on fanduelPlease note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website to access the W2-Gs & Year-End Reports. DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need . It’s possible that gambling winnings, when added to annual income, could vault some players into a higher tax bracket. Marginal tax rate is your income tax bracket. Effective rate is the actual percentage you pay after deductions. The state tax rate ranges from 4% to 8.82%, depending on your New York taxable income.

“@Marjohn07544788 Message”

taxes on fanduel|Taxes on Sports Betting: How They Work, What’s